And in April, their purchases of long-term securities at Treasury auctions increased.

By Wolf Richter for WOLF STREET.

Buying US Treasury securities was all the rage among foreign investors in March, despite whatever turmoil there was in the media. All foreign investors combined, from central banks to private investors, increased their holdings of Treasury securities by $233 billion in March from February, and by $942 billion over the past 12 months, to a record $9.05 trillion (red in the chart).

The majority of what they bought were long-term Treasury securities, which increased by $133 billion to a record $7.63 trillion, according to data by the Treasury Department Friday afternoon (blue in the chart).

The buying was across the major holders, except for China and Hong Kong combined, and for Ireland. Of particular note: Canada’s holdings of Treasury securities spiked majestically in February and March, despite the tariffs and the ultra-sour mood in Canada about US-anything.

Over the years, foreign holdings have increased in dollar amounts as the above chart shows, but the US debt has ballooned even faster than foreign investors have added to their holdings, and so their share has declined over the years, while US domestic buyers stepped in and loaded up. The low-point of the share of foreign holdings was in October 2023, when it dropped to 22.2% of total US Treasury securities. Then the share of foreign holdings increased again.

Since the beginning of 2025, the US debt has been at the debt ceiling of $36.2 trillion, and cannot increase until Congress lifts the debt ceiling. So as foreign holders continued to add to their holdings, their share of the debt-ceiling-limited debt shot up in March to 25.0%.

When the debt ceiling is lifted, and the US adds maybe close to $1 trillion to its debt in just a few months, the foreign share of that ballooning total will decline again.

Auction purchases by foreign investors through April.

Foreign investors can purchase Treasury securities in the market and at US Treasury auctions. The Treasury department publishes the amounts of auction purchases by foreign investors twice a month. The most recent Treasury Auction Allotment Report on May 7, which covers all auctions through April 30, shows that foreign investors purchased $36 billion in notes and bonds (“coupons”), for a share of 9.7% of the $370 billion in notes and bonds sold to the entire market (Fed purchases excluded).

Both the dollar amount and the 9.7% share were higher than in March. And the rumors raging in April, spread by the anti-tariff clickbait crowd, that foreigners were boycotting the Treasury auctions to punish the US government for the tariffs, were shot down by reality.

But we can see the longer-term trend that buying by foreign investors has not been keeping up with the ballooning auction sizes needed to fund the ballooning deficits.

As domestic buyers have to pick up a greater share, higher yields may be needed to make the securities attractive enough to pull in an ever-larger body of domestic buyers.

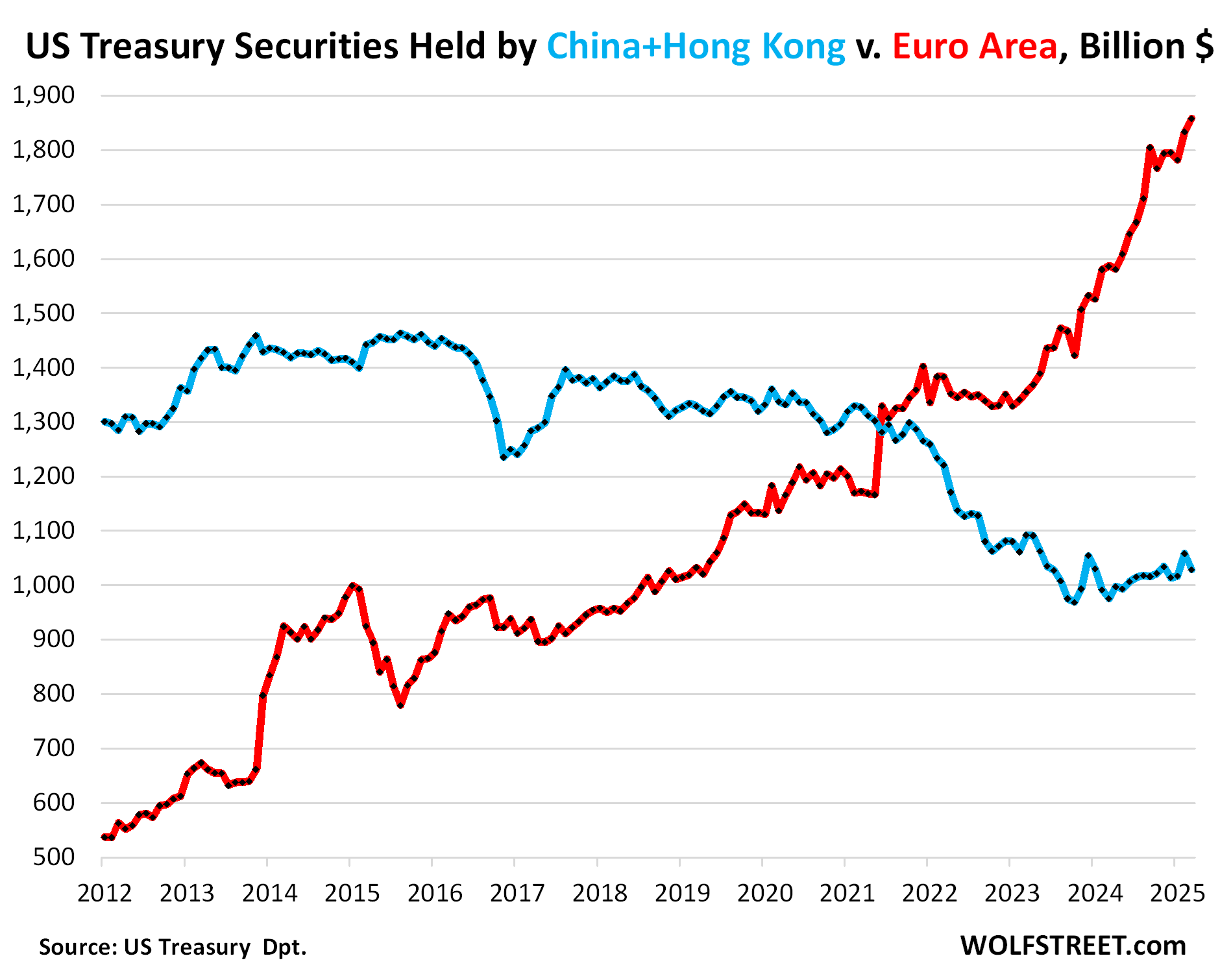

Euro Area v. China + Hong Kong.

China and Hong Kong combined shed $30 billion of their holdings in March, reducing their holdings to $1.03 trillion. But over the past 12 months, they still increased their holdings by $53 billion. Since the 2015 peak, they’ve shed about one-third of their holdings (blue in the chart below).

The Euro Area added $24 billion in March and $271 billion over the past 12 months, bringing its holdings to $1.86 trillion (red in the chart below).

The biggest holders within the Euro Area are the financial centers (Luxembourg, Ireland, Belgium, see further below) and France, whose banking system also functions as a global financial center. Their combined holdings rose to $1.51 trillion, accounting for 81% of the Euro Area’s total holdings.

Japan’s holdings edged up by $5 billion in March, after the big jump in February. Since 2012, Japan’s Treasury holdings rose and fell and rose, but in March at $1.13 trillion, were back where they had been in 2012:

The six largest financial centers are rocking and rolling: They added $85 billion in Treasury securities in March (+3.3%!), and $332 billion over the past 12 months, to a record $2.69 trillion. Since 2019, their holdings have nearly doubled. Since 2012, their holdings have nearly quadrupled!

These countries specialize in handling the financial holdings of global companies, individuals, and governments. Ireland is a favorite for US Big Pharma and Big Tech to store their profits. Belgium is home to Euroclear, which has $40 trillion in assets under custody for companies, governments, and wealthy individuals, and a sliver of that is in US Treasuries. The United Kingdom here means the “City of London,” one of the top financial centers in the world.

So a portion of the holdings at these financial centers are actually held by US entities.

Ireland was the only one of the six financial centers to book a month-to-month decline. Luxembourg’s holdings were essentially unchanged (+$12 million).

Increases in March, and total Treasury holdings:

- United Kingdom: +$29 billion, to $779 billion

- Luxembourg: unchanged, at $412 billion

- Cayman Islands: +$37 billion to $455 billion

- Ireland: -10 billion to $329 billion

- Belgium: +$7 billion to $402 billion

- Switzerland: +$21 billion to $312 billion.

The United Kingdom added $29 billion in March and $43 billion over the past 12 months, bringing its holdings to $779 billion. The UK is also included in the list above of the top 6 financial centers, but it’s by far the biggest and deserves its own chart:

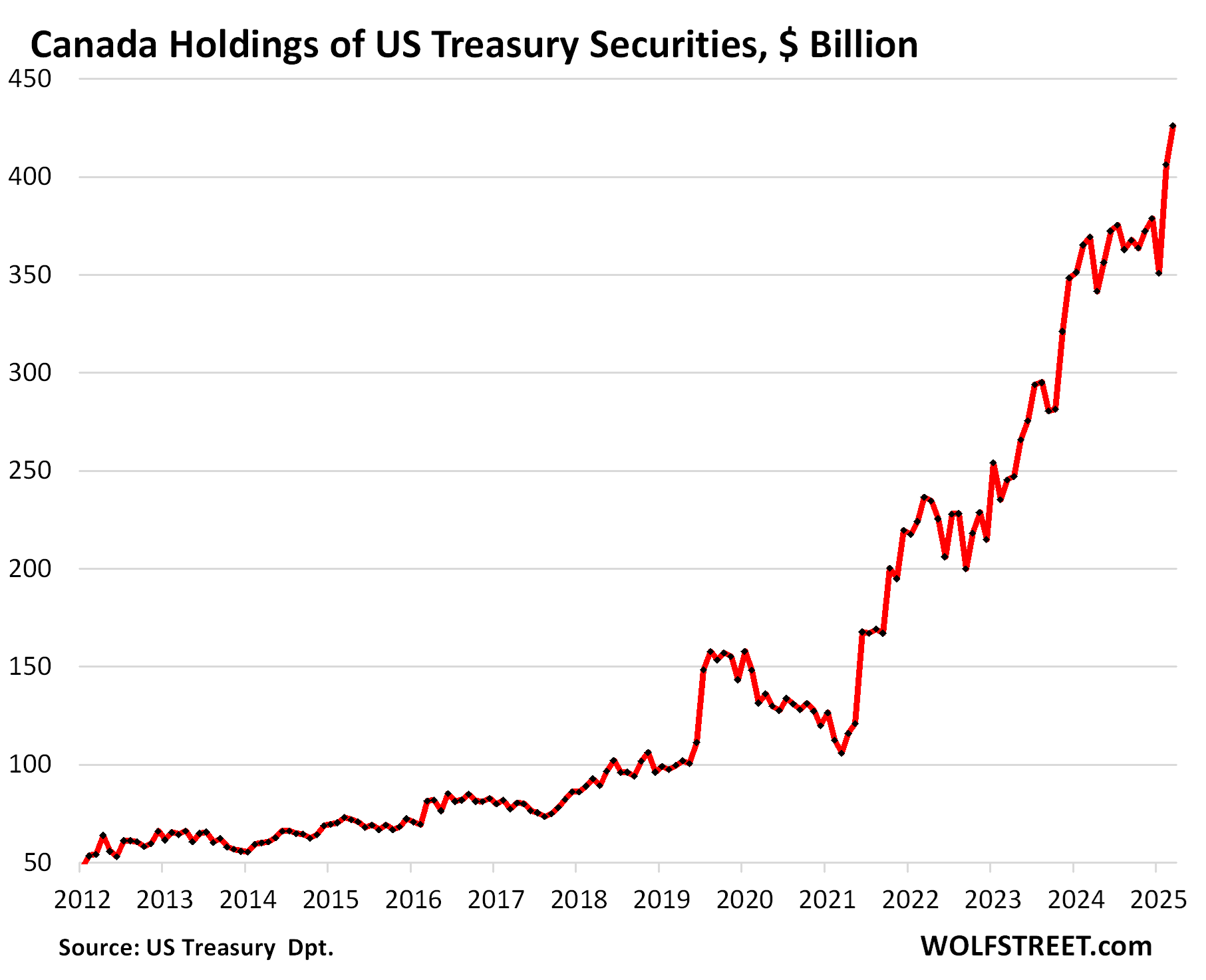

Canada’s holdings spiked by $20 billion in March after the $55 billion spike in February, to $426 billion. Since March 2021, holdings have quadrupled! Since 2012, holdings have octupled!

France’s holdings rose by $9 billion in March, and by $91 billion from a year ago, to $363 billion.

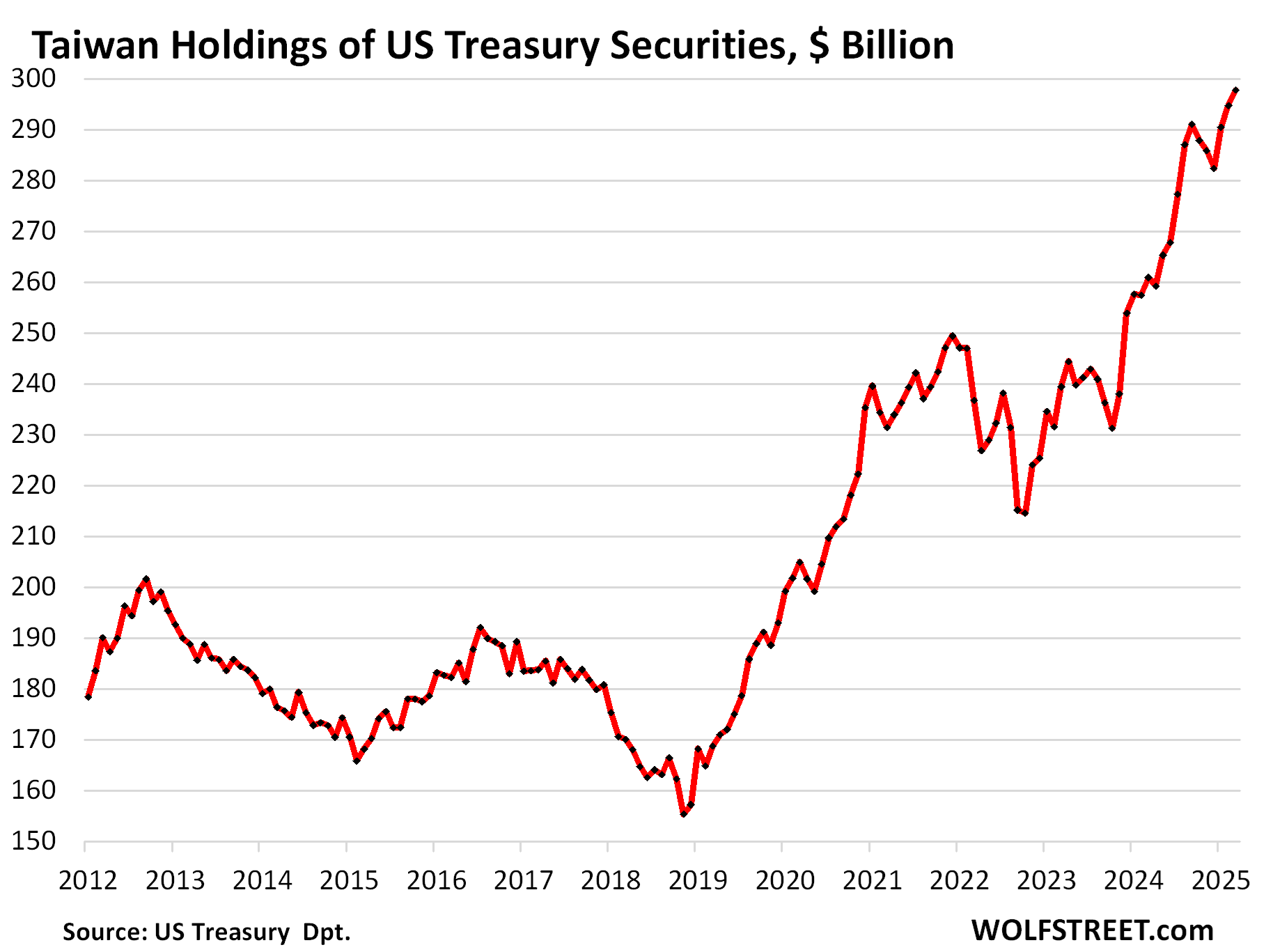

Taiwan’s holdings rose by $3 billion in March and by $37 billion year-over-year to a record $298 billion:

India’s holdings jumped by $12 billion in March, the third month of increases, after three months of declines, bringing its holdings back to $240 billion, roughly unchanged year-over-year. The high was in September at $247 billion. Since 2012, its holdings have sextupled:

Brazil increased its holdings by $1 billion in March, to $208 billion, the second month of increases, after a series of declines. Since the peak in 2018, its holdings have fallen by 36%:

In case you missed it: How the Debt Ceiling Is Now Pouring Liquidity into Financial Markets, only to Suck it Back Out Very Fast Later this Year

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Nice increases from our long-time allies and trade partners…..in March. It will be interesting to see if April and the next few months change much. Doubtful. Most other governments aren’t transactional nor short-sighted.

Auction results in April (see above) tell us that foreign investors increased their purchases of long-term notes and bonds in April, which is key. So April holdings, when released a month from now, won’t show a fiasco either.

Understood, and seems unlikely they’d be selling at the same time. Any sharp adjustment would have been too quick, too rash anyway.

While I’m tolerant of the shop talk about the current inflection on the graphs. Disregarding the asymptotic like correlation between the Fed’s machinations required to funding of the US’s multiple deficits including the fiscal budget deficit and it’s mirror image, the trade deficit, and the accumulation of USG debt.

Each economy appears to have been stimulated by buying USG’s debt with freshly manufactured sovereign currencies which the dollar is obliged to absorb in order to maintain the agreed upon relative value.

Or they felt like gambling.

US 10Y @ 4.5% (was at 4% on April 4)

US 30Y @ 5.0% (was at 4.4% on April 4)

What happened?

Both were about 50 basis points HIGHER in January. So why did they drop, when they shouldn’t have. What happened? Nothing happened. They fluctuate. You just cherry-picked the low point after a long drop that nearly guaranteed a snap-back.

Curious how UK got the money to buy so much US treasury bonds. It can’t be all investment funds.

“City of London” financial center, similar to Luxembourg or Cayman Islands. It’s not UK government money or UK individuals’ money. It’s international money, corporate profits that get sheltered there, hedge funds, etc.

What is additionally curious is why in the hell does that shrunken head, the British empire, have any say at all in US foreign policy.

The Irish survivors, like me are willing to admit watching a program of attractive English people who obviously are portraying a choreographed propaganda,

There is only one infallible test developed, mostly by my mistakes across the decades. Augmented with an education about the copious atrocities across history and that would be love. Come what may, love will out.

In fact, America’s heritage is about brotherly love.

As near as I can tell, the same sentiment, love, is more likely to be rational than foolish

Let’s see what happens if and when the they pass a big tax cut bill. It would evidence a lack of fiscal discipline for the foreseeable future.

We need a big tax cut for the oligarchs and billionaires! Isn’t that what we voted for?

Huge hurry to get tax cut bill through, before tariff tax hikes hit the everyday costs of the little guy. I have heard around here that retailers eat those costs, but I don’t think that’s what WalMart just said.

Meanwhile all this 30,000 feet level, 30year duration stuff may hold up? If so, not the worst of worlds, yet.

I’m thinking that the hurry to get key legislation through the senate – Budget, tax cuts, debt ceiling is because until that happens Trump cannot commit one way or the other on Ukraine. Lindsay Graham says he has 72 Senators lined up to vote for “more war”. At the same time a good bit of Trumps MAGA base is solidly “no war”.

Ukraine is a huge distraction and drain. If you take Trumps words in his speech from Saudi seriously, he’s sick to death of Neocons and Nation Builders who have spread ruin around the globe. He would prefer commerce, but 72 Senators want More War. And Trump is frozen in Amber until he can get some key legislation.

phleep

You’re abusing my site to spread Walmart’s manipulative corporate propaganda here.

Walmart is trying to manipulate people into accepting higher prices when until now they’re not accepting them. When Walmart raised prices, sales fell, and so Walmart CUT prices in 2023 and 2024, and booked big sales gains and market-share gains. Now it’s trying to manipulate people into buying from Walmart anyway despite the price hikes. Walmart is just trying to fatten up its profit margins.

Trump blasted Walmart for these manipulative antics and told Walmart and China to “eat the tariffs.”

People need to refuse to pay higher prices, they need to stop buying a product whose price has risen. That is THE ONLY WAY to battle inflation. And it worked in 2023 and 2024, and many prices came down. But people failed to do that in 2021 and 2022 when they had all this free money, and they GOT RIPPED OFF.

Now Walmart is trying to do it again, and it’s f**king with people’s minds, including YOUR mind, and YOU are helping Walmart spread its propaganda.

This is where inflation (price increases) in recent years went: effing corporate profits, including Walmart, while they ripped Americans off. Americans need to stop paying for higher prices, and Americans are pretty good at that, which is why Walmart came out with its propaganda.

Wolf, if we can believe accounting, WMT’s margins are under 3%. Of course that includes all kinds of overhead, so no clue how much their cost of goods sold are.

“Walmart CUT prices in 2023 and 2024, and booked big sales gains and market-share gains. Walmart is just trying to fatten up its profit margins.”

Ok, so they’ve thinned their profit margins already, and you think it’s cool for the president to expect them to thin them even more?

To say “they need to stop buying a product whose price has risen. That is THE ONLY WAY to battle inflation”… I get your view. Someone needs to be the one who “eats” the loss. Walmart would rather it be you than them.

I have no love for Wallyworld, FYI.

3% net margin after taxes is a lot for a retailer. they don’t do anything at all other than re-selling a product they bought. Their gross margin might be 50% or 100%. The difference goes to overhead, transportation, executive bonuses, payrolls, etc.

I like how Gattopardo put it: ‘Someone needs to be the one who “eats” the loss. Walmart would rather it be you than them.’ And Trump wants Walmart and China to eat them.

Tariffs are a tax on the cost of imported goods. If prices go up (via supply and demand), then it’s kinda-sorta like a sales tax. If prices don’t go up (again, supply and demand), then it’s kinda-sorta Wolf’s tax on corporate profits.

It’s like those articles about hypothetical $3,000 iPhones — if supply and demand allowed Apple to charge, $3,000, they’d be charging $3,000 now!

I imagine it’ll split the difference: prices will go up and corporate profits will go down. And some number of marginal businesses will close.

Hi phleep,

Substituting bias for research is not conducive to reasoned analysis. The WMT is readily available. Maybe those who read the comments would be better served if folks bothered to look behind the curtain before they opened their pie hole.

Does the data help?

WMT 2024 Gross Sales $619B up 1% YOY

WMT 2024 Operating Income $23B up 5% YOY

WMT 2024 Net Income $15B up 33% YOY

WMT Gross Margin 3.5%

WMT Corporate Taxes $5.8B

Note: i am concerned for Wolf’s possible mellowed personality. I would have excepted an acerbic reply.

Thanks Wolf, I agree it would help resist inflation if people would not just pay whatever. Maybe I’m naive but I also think another way to fight inflation is for people to not vote for politicians who deficit spend and I know that would require big cuts, and asset prices would likely fall (not a bad thing), layoffs, etc. but more sustainable jobs could then develop. The Libertarians are the only choice that say they will balance the budget. We should at least see if they would stay true to their word.

They will never fix spending so I fully support even bigger tax cuts. If you want to pay for the extra spending, write a check.

Yes, yes, I know, we are all in this together.

The reality is our fiscal problems would be pretty easy to fix if there were no politics involved. But the politics means it will be practically impossible so it’s necessary to break the system. Tax cuts will help do that. We will have pain eventually so I’d prefer some relief now. In fact I’d say the longer we wait to fix things the worse the pain so my way will ultimately be less painful.

What happens to anyone whose income goes down while expenses go up??

Bankruptcy

How are governments different??

Robert, they (governments) can print their own money.

Hi Dan,

Are you suggesting that our Federal has a spending addiction rather than a revenue problem?

Consider the implications if the Federal government were to cut spending? How could it afford to make its estimated $1T in annual fraudulent payments?

Nothing will get fixed until legislation is passed to overturn citizens united followed by campaign finance and insider trading reform. Politicians don’t work for the voter. They work to self enrich.

Anthony A. govts can do printing for a long time but not forever. I think the USA would be healthier now and in the future if we maintained stable purchasing power but just my opinion.

I highly doubt other nations really care about that. Likely they’ve priced in very large deficits going forward.

The U.S. is actually better managed than most nations. Other countries could only envy its governmental practices.

What is this “fiscal discipline” you speak of ? I don’t believe we have that on my planet.

Fiscal discipline pales in comparison with the wholesale transfer of American manufacturing to the Chinese Communist Party who underbid starvation wages.

In a strange way, the cleansing situation that often follows the mortal death of one of us is worse.

Personally, I would like to set the record straight before I croak within the statistically expected enveloped. Love is life.

Thanks for this. Super interesting. Wondering if this increase in purchases from Canada was to stabilize the currency during the election campaign which ended 28 April? Or perhaps re-investments of the trade surplus?

But looking at your long-term chart, although there was a spike, this has been trending way up for quite a while.

Love how this is presented by the way

Any conclusions to reach from this other than foreign governments continue to see US as virtually risk free investment and dollar remaining relatively stable? Seems like if yields did rise it would just attract more foreign investment, until such time something more significant changes. Most foreign investors have likely arrived at the conclusion that the US debt problem will get worse not better, despite propaganda from Washington. Our government is if not anything else, predictable. Short term election to results always win over long term.

The last time the “risk free” sobriquet was suggested, was during Wolf’s housing bubble 1

IMO, assets are overvalued and the inertia of interest rates is too low to extinguish the chronic inflation which

silently eats away at the fixed wage budget

Concentrates wealth to people that are convinced that some how they deserve it.

Does “long-term securities” mean anything with a coupon?

Yes. So 2-year to 30-years.

Thanks

T-Bills are sold at a discount to par (100) and mature at par in 1- to 12-months. Treasury Notes have maturities of 2- to 10-years and are sold at auction at (close to) par. Treasury Bonds have maturities of 20- to 30-years (anything longer than 10) and are issued at or close to par.

THE “long bond” is the most recently auctioned 30 year Treasury coupon-paying bond; it trades slightly “richer” (more expensive than) previously issued 30 year T-bonds.

“Duration” is not the same as “maturity.”

Dealers make 30-year Treasury zero-coupon bonds by buying chunks of the 30-year T-bond auction, depositing them into a trust, and then sell from the trust a structured 30-year Treasury Zero-coupon bond — an extremely volatile int rate product long beloved by insurance companies, etc.

The duration of a newly issued 30-year Treasury zero-coupon bond is 30 years. But the duration of the most recently issued 4.75% coupon 30-year Treasury Bond is only 16.5 years — much less volatile than the zero-coupon bond — because of the annual 4.75% coupon payments.

Both the 30-year coupon-paying Treasury bond and its 30-year zero-coupon-paying Treasury bond cousin are—to use your words—”long-term securities.”

Great summary, Tbl-

Of interest would be:

– % of Treasury securities held by Foreigners, over 50-60 years

– Average duration of Foreign-held Treasuries, if such a thing exists.

I would think that larger % held by Foreigners and longer duration would imply bigger rate volatility, but maybe I’m imagining that connection…

Seems I’m not able to reply to your above posts. Wasn’t it you a month ago who said tariffs weren’t inflationary? We were all Globalist BS propagandists. Now you’re saying Walmart should eat price increases from their fat margins and not pass the increases to poor MAGA consumers. So what, now you’ve seen the tariff inflationary light? Oops!

Don’t stick BS into my mouth. That’s one of the seven deadly sins of commenting here. If you don’t remember exactly what I said, or are too lazy to look it up, STFU.

What I always said:

Tariffs are a tax on corporate gross profits, and whether or not they can pass on that tax depends on market conditions.

What I also said:

Companies were largely NOT able to pass them on in 2018 and 2019, and inflation measures of durable goods (where most of the tariffed imports were by value) remained negative during that time.

And I showed you a chart of durable goods inflation covering that period.

But inflation EXPLODED under Biden. Those were the direct “Biden tariffs” on consumers and they went to corporate profit margins (Biden’s catastrophic free money policies). And in the comments above, I showed you a chart of corporate profits, and how they exploded under the “Biden tariffs” that consumers DID pay for.

Whoa now, Wolf. Your narrow “(Biden’s catastrophic free money policies)” is atypical of you. You know Trump set the tone with giant giveaways first, the Fed dumped gas on the whole thing, enabling both, and that all this stuff runs on a lag.

We have multiple perps….

Gattopardo

If you read any of my articles back then about the free money stuff, you would not have been surprised now. I lambasted these policies in lots of my articles. They turned into a huge “tariff” on consumers but by companies, that massively fattened up corporate profits, as you can see in the chart. Back then, we didn’t have the data we now have, but I lambasted these policies back then anyway, including Biden’s EV incentives.

But you’re right: They’re ALL perps. Just in different ways. But Trump is right about the tariffs — this is long-overdue economic policy after four decades of policies that purposefully have sacrificed manufacturing in the US at the altar of fat profit margins and high stock prices.

The Cayman Islands stepping up big. Lol

That’s a favorite location of large hedge funds that try to avoid and/or evade US tax. Cash held in Cayman, Ireland, Bermuda, etc. could grow significantly now that IRS enforcement budgets are being cut 20-50%.

Let’s be real. Even with 100% budgets the IRS was hauling in Billionaires or even multi millionaires. They can afford competent up to great accountants. It’s upper middle and middle class people the IRS hang out to dry.

Don’t believe me? Name me a time a wealthy multi millionaire or Billionaire went to jail for tax evasion. Should be big news and easy to find if it happened.

Do you know that IRS enforcement is civil rather than criminal in 95% or more of cases? There’s a lot more to tax enforcement than putting people in jail. It’s mainly about making people pay tax, penalties, and interest.

Robert Brockman died just before his trial for 2 Billion $ tax fraud. Allen Stanford is serving a 110 year sentence for a 7 Billion $ fraud scheme. Of course Bernie Madoff. Google is your friend. Look it up.

The hardest task with the IRS is to reclaim funds once they have collected the funds. The taxpayer bill of rights is an enigma that doesn’t apply in real life,

Kind of like a kid piling up blocks

Eventually, the pile falls down

Lotta ammo if things escalate but not sure anybody wants to push the economic nuke button.

Off topic but the Walmart rhetoric seems ironic.

Shouldn’t we just let the free market decide on prices?

Walmart go ahead and try to raise prices and consumers vote with their wallets simple as that.

I’m sure there is examples of price controls working and examples of them not working but I feel like free market is what people thought they were voting for.

Free markets imply that there is no government intervention and so on which we have a lot. Plus it is hard to look at the likes of Walmart and Amazon and see them very much like planned economies. In reality we are a mixed economy, which of course is broad as that is basically the Chinese model but with more socialist characteristics.

Totally agree we haven’t had free markets for some time just funny to me with how much the socialist word was thrown around and then boom when it benefits you know who it’s corporate greed🎪🤡🎪

American dream,

While many distinctions the key difference in simple terms is that the Chinese government controls the leash with companies. That leash can be quite generous and the government can have a small amount of special type of shares which give them voting rights. This was necessary as China recognized to compete with #1 economic power it hd to. Compare that to the US where those that own the leash are the corporations and the government might nip at the leash but they know who feeds them. In Chinas case this always very competitive sectors but ensuring the long term interests of the people are out first. The Chinese revolution wasn’t very long ago and their progress by any standards has been monumental.

The issue is not profit, that is an economic concept and exists in both. It is where the profit goes combined with stable policy making, which is also possible.

The US could make improvements of course, such as eliminating money in politics but it would still be stuck with no long term ability to create policies and commit to them.

There is no doubt in my mind or in most people’s mind who dominate the technology race, addressing climate change or any number of factors.

I read Atlas shrugged in my late 20s, it inspired me so much i started my first business and became a lifelong capitalist. I always expected a liberal government to be the major villains in my life with price controls and crony capitalism. I was wrong!! Is the road to hell paved with good intentions or bad actions?

Atlas Shrugs is just another Communist manifesto. Total trash. That said, that author renounced it and started coming to reality. Lil Ayn never did.

Gregory Midden,

That is the strangest analogy I have ever seen. Atlas Shrugged was a fictional novel whereby the Communist Manifesto was a political pamphlet addressing the inherent class contradictions, among other things, with relations of people in the means of production. It was set in the very real revolutions they were occurring at the time in Europe.

Some might argue with the increasing wealth inequality it is still a very relevant read, especially given the conciseness and brevity.

Glen, from the little I read, the communist manifesto seems to me to be the authors opinion, how things appeared to them and it seems to focus on blaming others, trying to create a division between people, instead of encouraging people to be humble and work. It’s surprising to me that real govts used that book for direction.

Will be interesting to see how Canada’s selling of their gold holdings at under $1000/oz to buy USA debt holdings plays out over the longer term

Some interesting but not all that surprising info on US Treasury buying. The recent past several months of buying by Canada, etc. is likely just a back door way of “making nice” with Trump; a gesture largely hidden from public consumption. I could be wrong though.

The US has painted itself into a tight corner and it’s not pretty. Trump is foolish for pushinng the renewal of these tax cuts. It will only worsen the debt. Everyone better start getting prepared for the ultimate resolution of this crisis. Treasury yields are going to go alot higher; the US will lose control of the bond market and all those dollars will flood into other real assets, one of which is gold. We are going to see signficant stagflation in the US; no way to stop it.

The problem was really the first round of tax cuts he did in first term. If you pass permanent corporate tax cuts but expiring individual rates you will have a future problem. Tax payers will not see expiration of tax cuts as that, but a tax increase, which in all practicality it is. Not a winning formula for winning midterms and the economy. The US will never right the ship as our entire history has been short term elections over the long term. Even the New Deal was for that purpose as FDR couldn’t lose 30 million voters. Certainly a good thing but he was a balanced budget politician, not a massive deficit spender.

re: “We are going to see signficant stagflation in the US; no way to stop it.”

The FED’s Ph.Ds. are learning:

nonbanks vs. banks liberty street.pdf

“Activities and related risks of banks and nonbanks remain intimately connected, indeed in a symbiotic relationship…”

George Santayana said: “Those who cannot remember the past are condemned to repeat it”. In the area of economics is it more accurate to say that those who believe economic history reveals eternal truths are doomed to error.

This is the first boom/bust since WWII that wasn’t marred by disintermediation of the nonbanks (an outflow of funds or negative cash flow).

Hi Mike,

I don’t give a fig about the DC Kabuki theater, but your comment did prompt a couple questions.

Won’t letting the TCJA expire will constitute the largest ever tax increase in U.S. history and transfer in the neighborhood of 1.5% of GDP from the private to the public sector?

In spite of the dire warnings, did tax revenues fall after the JCTA was passed? Given the effect of the GDP makes anyone think revenues will increase if the JCTA isn’t extended?

There is nothing to say that Trump’s tax cuts couldn’t be phase out over 4 years. You are right to suggest that the eliminating the tax cuts won’t solve the deficit problem and may even contribute to a slower economy. But the problem, in my opinion has to be tackled from both ends..higher taxes and lower spending. There has to be pain on both sides of the equation; especially if we are to preserve some semblence of social cohesion.

I’ve read this article and looked at the charts multiple times, each time I have less confidence that the foreign buyer appetite can’t keep up with new supply. Canada chart of holdings went parabolic, it looks like a classic Eiffel Tower pattern, if it corrects look out. The concern just got shifted into the future. The overall foreign buyer chart spiked in mid 2022. Are those charts going to dip down at exactly the wrong time for us needing buyers? The trend is your friend until it’s your enemy.

How much of theses foreign investors are central banks (public entities) or private entities/private investors?

$3.93 trillion are held by “foreign official” entities, so central banks and governments. Of that, $3.51 trillion are Treasury notes and bonds. And $420 billion are T-bills.

10-year yields looked like they fell during this period, i.e. “loading up on Treasuries’ “.

https://fred.stlouisfed.org/series/DGS10

I like to see efficiency where possible. Everytime Wolf has to tell someone to stop reading pure BS articles meant to get your goad it’s like watching an old time cop beating a drunk about the face and yelling, “Sober up!”. So in the interest of brevity with a modern twist, I think he should just open those boxes with, “Let me whack the bots out of you…RTGDFA!” Simplified.😜

GDP should be measured on a yearly basis and not from a quarterly basis.

1/1/2019 21111.6 0.039

4/1/2019 21397.938 0.040

7/1/2019 21717.171 0.044

10/1/2019 21933.217 0.049

1/1/2020 21727.657 0.029

4/1/2020 19935.444 -0.068

7/1/2020 21684.551 -0.002

10/1/2020 22068.767 0.006

1/1/2021 22656.793 0.043

4/1/2021 23368.861 0.172 too high

7/1/2021 23921.991 0.103

10/1/2021 24777.038 0.123

1/1/2022 25215.491 0.113

4/1/2022 25805.791 0.104

7/1/2022 26272.011 0.098

10/1/2022 26734.277 0.079

1/1/2023 27164.359 0.077

4/1/2023 27453.815 0.064

7/1/2023 27967.697 0.065

10/1/2023 28296.967 0.058

1/1/2024 28624.069 0.054

4/1/2024 29016.714 0.057

7/1/2024 29374.914 0.050

10/1/2024 29723.864 0.050

1/1/2025 29977.632 0.047 Just right

Just to clarify, your second column (after the date) is seasonally adjusted annual rates of current-dollar GDP (not adjusted for inflation). And the third column is year-over-year growth rate. For example, your 1/1/2025 = Q1 2025, current dollar GDP of $29,977 billion, or $29.98 trillion SAAR, and year-over-year growth rate of 0.047 = 4.7% not adjusted for inflation.

The data shows that the FED was late in easing and late in tightening.

No, the data — including these charts — show that the Fed was easing way too much, and should have never eased that much, and was way late in tightening.

Makes me wonder whether the increase in treasury purchases is related to the back room trade negotiations going on to placate the US administration. A sort of “Buy my debt” and will defer the tariffs.